Enterprise SaaS Giants: AI-Proof. For now.

Assessing the Threat of New Entrants & Rivals for Enterprise SaaS Companies in the Age of AI Advancements

Many industry observers have speculated about AI’s recent advancements to disrupt established market dynamics. However, a closer examination suggests that AI features, as a differentiator, may not pose a significant threat to incumbent Enterprise SaaS market leaders' market share—at least not in the immediate future.

SaaS market leaders can afford to take a measured approach to AI integration. While carefully monitoring developments and selectively targeting AI features is critical, there’s a compelling case for companies to wait on widespread, hasty adoption. This is because of three key factors: (1) the lack of first-mover advantage in AI innovations, (2) enduring barriers to entry, and (3) the data and API advantages held by incumbents.

1. Lack of First-Mover Advantage

Rapid advancements in AI lower the barrier to entry for new entrants. In a recent Forbes article, Tommy Vilkano says, “Investments topping $100 billion worldwide in 2023, along with 24% of all corporate VC investments directed into it, clearly shows that AI is driving the creation of new businesses”.1

Many are rushing into the golden age of AI with features and even companies. However, for large, existing SaaS companies, being first to market for AI advancements doesn’t seem to have a lasting advantage. This is for two reasons:

Effortless to be a fast follower. The availability of powerful foundational models has democratized AI capabilities. Large language models (LLMs) like GPT and its successors offer very powerful out-of-the-box APIs, from text generation to analysis and more. The ability to rapidly develop AI features is not unique to startups. Established SaaS companies can quickly follow and implement sophisticated AI features with comparable ease. Techniques like Retrieval-Augmented Generation (RAG), prompt engineering and fine-tuning have further simplified the process of building AI features. These approaches allow companies to leverage pre-trained foundational models and customize them for specific use cases without extensive AI expertise or resources.

The 90% Solution. While achieving competent AI features is within reach for many companies, the challenge lies in the final 10%: refinement and customization. This last stretch often demands substantial resources and domain expertise. However, users may not fully appreciate the marginal improvements offered by this final 10%. Consider the ongoing performance race between Anthropic and GPT, each striving for improved results. Yet, usage statistics suggest the differentiation may not be critical: Anthropic sees 65M monthly active users2, while ChatGPT boasts 600M monthly visits3. Even if the last 10% does become a key differentiator, incumbent enterprise software market leaders are well-positioned to leverage their treasure chest of resources and scale accordingly.

2. Enduring Barriers to Entry

Despite the accessibility of AI technologies, several significant barriers to entry remain firmly in place, protecting incumbent SaaS market leaders from potential disruption.

Switching Costs. One of the most potent defenses for established SaaS companies is the high switching cost for their customers. With customer acquisition cost averaging 11 months of revenue4, incumbents have a strong advantage. Organizations deeply integrated with a SaaS solution face significant hurdles in transition, especially given that enterprise customers with >$250K ACV have contracts that last longer than 3 years5. Moreover, successful SaaS platforms often have extensive ecosystems of integrations & plugins, enhancing value and retention. New entrants must develop both their core product and a comparable ecosystem to compete effectively.

Deep Domain Knowledge. Many SaaS categories require a deep understanding of specific industries or business processes. Incumbent leaders have accumulated this knowledge over years of serving their customers and refining their products. This domain expertise is not easily replicated by new entrants, even those with advanced AI capabilities.

3. The Incumbent Advantage: Data and APIs

Perhaps the most significant advantage held by established SaaS market leaders is their vast troves of data and well-developed API ecosystems. As noted in a recent Forbes article:

“The AI tech stack is rapidly becoming a commodity. Intelligence is turning into something like electricity—easily accessible, with the option to switch to a better or cheaper provider effortlessly. Instead, the future source of competitive advantage for most companies lies in the proprietary knowledge that fuels their AI systems.”6

- Joe McKendrick (Forbes).

These assets are crucial for developing and refining AI features that truly add value for customers. The depth and breadth of data accessible to established SaaS leaders provide a substantial competitive advantage in the AI-driven landscape.

Enterprise Data at Scale: While foundational models have currently been trained on public data (reddit, github, and the public internet), there is a vast amount of enterprise data yet to be leveraged. Incumbents are well positioned to capitalize on this opportunity. This proprietary data gives established SaaS leaders a significant advantage in training models tailored to specific business needs and use cases. Take these examples from Emergence Capital7:

Zoom: 3.3 trillion meeting minutes in 2020

Ironclad: 1 billion documents annually

Slack: 1 billion messages per week.

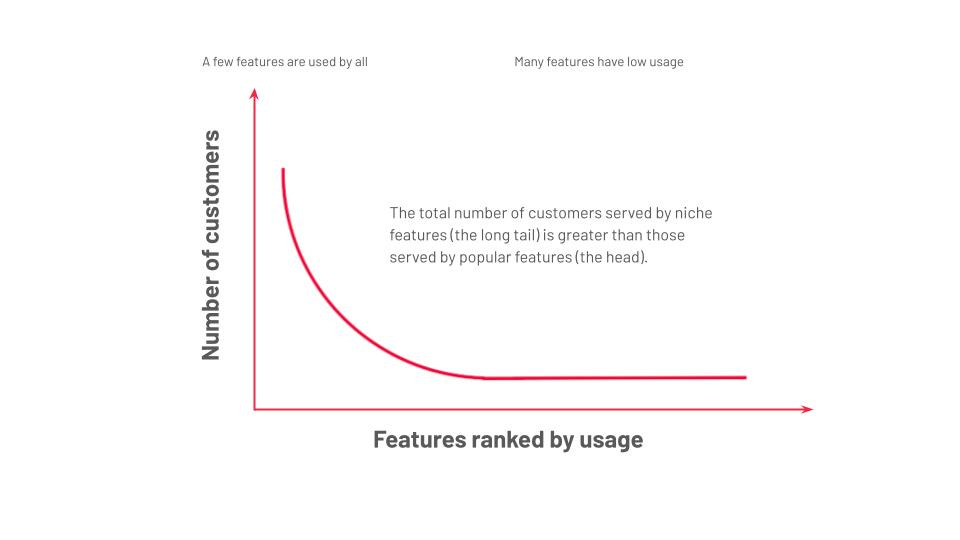

API advantage: New entrants may be able to develop advanced AI systems. However, established SaaS leaders hold a crucial advantage: control over the action through their APIs. These APIs serve as the gateway to the core connective tissue of different applications and services. This gives incumbent SaaS providers a powerful position, as they control not just the data, but the mechanism to implement the action.

Conclusion: A Measured Approach to AI Integration for Enterprise SaaS Companies

In conclusion, while AI advancements are significant, they may not immediately disrupt established Enterprise SaaS market leaders. Incumbents benefit from the ease of fast following, enduring barriers to entry, and their data and API advantages. By taking a measured approach to AI integration, leveraging their existing strengths, and strategically implementing AI features, these leaders can maintain their competitive edge in the evolving SaaS landscape.